Rent To Own : The Optimal Investment Strategy

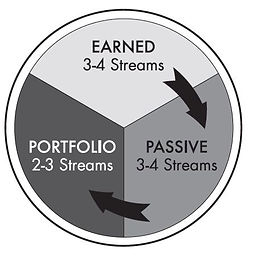

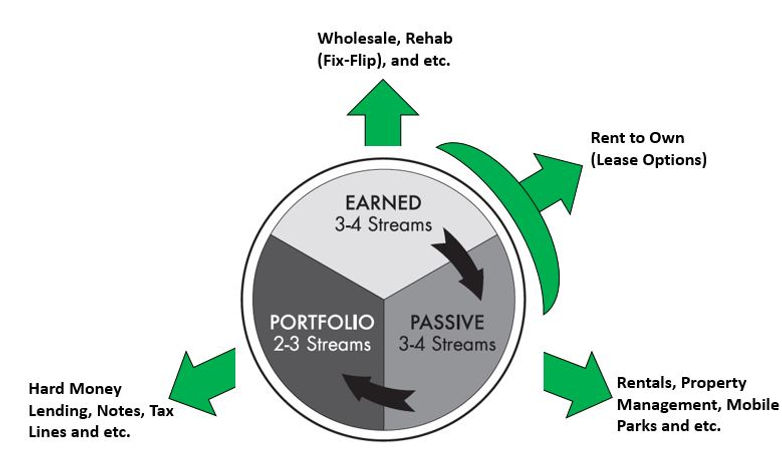

If you have not already heard about the circle of wealth, take a look at the picture below…

As an educated and knowledgeable investor, you have to diversify your real estate portfolio to mitigate the risks as much as possible. That is, you need to have each portion of the circle in your investment portfolio.

Earned income, refers to the part of the circle in which you can make quick cash. In real estate this could mainly be achieved by wholesaling or rehab (fix-flip).

Passive income is the money that comes to you week after week or month after month without you going out and doing anything. In real estate this could mainly be achieved by rentals, property management, mobile parks, commercial spaces and etc.

Portfolio income is when your money begins to make money for you—typically through interest. If you are just starting your real estate investment journey or you are partway through, this might not be the best option for you as it needs you to have large amount of money sitting in the bank.

Now that you have a basic solid understanding of the circle of wealth, let’s cover what we do in Kam Real Estate Solutions Inc….

In Kam Real Estate Solutions Inc, we are specialized in Rent to Owns (also known as lease options), and this is our main and only expertise.

Why Rent to Owns, and where is it located in the circle of wealth? We have selected Rent to Owns because it is the most optimal strategy for people interested in investing in real estate. This is a hybrid strategy which both brings to your portfolio earned and passive income, and could be done in any market.

In Kam Real Estate Solutions Inc. we do Rent to Owns, in 2/3/4 years term, on single family homes. That’s it!

In a Rent to Own investment, you, as our investor, receive 3-5% of the current purchase price of the property (initial option consideration) from the tenant buyer initially, think it as a wholesale. You will receive the difference between the future property value and its current purchase price at the end if the tenant buyer exercises the option to purchase contract, due to the property natural appreciation. Also, you will receive a healthy cash flow through out the Rent to Own term as a result of the lease and option contract, think it as a rental investment.

That’s not all of it… Here are some other benefits we can point out to you, as a Rent to Own real estate investor:

-

The strategy virtually eliminates the vacancy rate (tenant first!)

-

Dramatically reduces need for property management as tenant is responsible for minor or all repairs.

-

Encourages tenant to maintain property as a homeowner would (pride of ownership)

-

Provides excellent Return on Investment and positive monthly cash flow